Finance

Finance

5 Tips to Manage Your Personal Finances

Need help managing your finances? Look no further! This blog post offers five simple tips to get your personal finances in order.

Managing your finances can seem like a daunting task, but it doesn’t have to be. With just a few simple steps you can get your finances in order and set yourself up for success. In this blog post we offer five easy tips that can help you better manage your financial situation.

Set Finance Goals.

Setting financial goals can help you stay on track and achieve the financial freedom you desire. Start by setting small goals that are based on your current financial situation, then move up to more ambitious goals as your finances improve. Before you know it, you’ll be well on your way to achieving true financial success.

Create a Budget and Track Your Spending Habits.

An effective budget will allow you to easily track your spending and see where your money is going. You should also keep an eye on changes in your financial situation, as well as any discrepancies between budgets and actuals. Creating a budget can help you stay organized and reach your financial goals more efficiently, while tracking your expenses can help you identify any areas of unnecessary spending that you can cut back on.

Consider Automated Savings Solutions.

Automated savings solutions can be incredibly useful when it comes to managing your personal finances. With apps like Digit and Acorns, you can turn saving into a habit by having a set amount transferred from your paycheck directly to a saving account or investment portfolio. This way, you won’t have to think about saving – it will just happen automatically!

Don’t Overspend on Credit or Loans.

While it may be tempting to want the newest gadget or go on that trip, it’s important to stay mindful of your budget. Overspending can lead to higher debt and a decrease in overall financial stability. When thinking about making a purchase, be sure to weigh all the costs and consider whether you really need it or if you can wait until you have saved enough.

Monitor Your Credit Score Regularly.

Monitoring your credit score is essential to understanding your financial status. Your credit report offers a comprehensive snapshot of all the loans and accounts you’ve opened, how you pay your bills, and more. As such, it’s important to check your credit report regularly (at least once every three months) and make sure that the information on it is accurate. This can help you better understand how lenders view you when making decisions about loan approvals or interest rates.

-

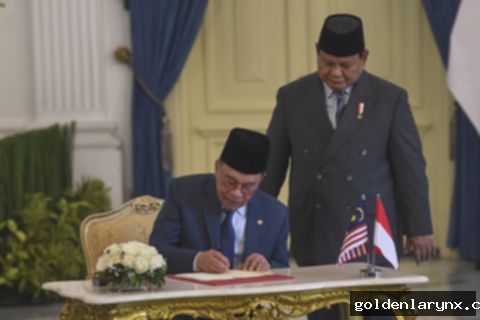

Investasi Indonesia-Malaysia: Anwar Ungkap Potensi Besar yang Belum Digarap

PM Anwar: Potensi Investasi Indonesia-Malaysia Besar, Bisa Lebih Dioptimalkan #newsupdate #news #update #text

-

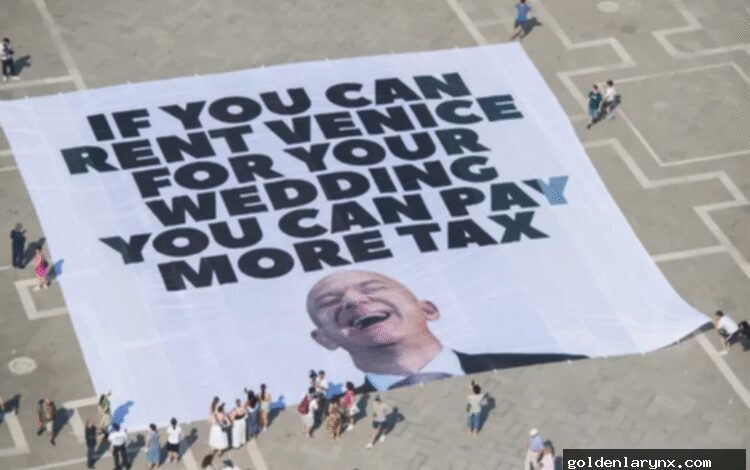

Jeff Bezos Pindah Tempat Pernikahan Setelah Diusir Warga Venesia

Pernikahan Jeff Bezos yang sedianya digelar di gedung bersejarah Scuola Grande della Misericordia, kini dialihkan ke wilayah Arsenale.

-

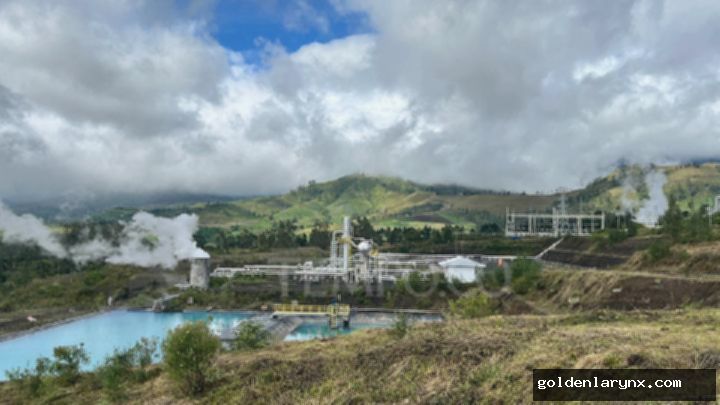

Prabowo Resmikan Penambahan Produksi 30 Ribu Barel Minyak di Blok Cepu

Dengan penambahan produksi minyak 30 ribu barel per hari, maka total lifting di Blok Cepu menjadi 180 ribu.

-

BSU Cair untuk Lebih 2 Juta Pekerja. Simak Cara Mengeceknya

Kementerian Ketenagakerjaan bilang bahwa BSU telah cair. Bagaimana cara mengecek status penerimanya.

-

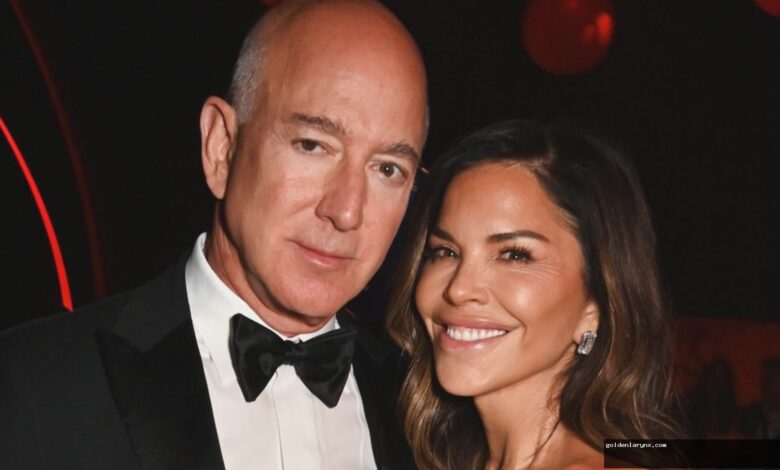

Pernikahan miliarder Jeff Bezos dan Lauren Sanchez menuai aksi protes

Amazon founder Jeff Bezos and fiancée Lauren Sánchez are set to tie the knot this week in a lavish three-day celebration in Italy. The multi-million dollar wedding is set to go ahead despite being plagued with controversy, including protests, days before their nuptials. Public backlash over the extravagance and disruption caused by the billionaire ceremony appears to have pressured organisers…

-

Jeff Bezos Nikah di Venesia: Ledakan Pariwisata atau Sekadar Sensasi?

Turis melaporkan penutupan yang tak terduga, lalu lintas yang dialihkan, dan suasana yang dipenuhi paparazi menjelang pernikahan Jeff Bezos.

-

Pesta Pernikahan Jeff Bezos di Venesia Diprotes Greenpeace

Resepsi pernikahan Jeff Bezos dan Lauren Sánchez yang digelar akhir pekan ini di Venesia, menuai protes dari beberapa pihak, termasuk Greenpeace.

-

Perang Iran-Israel Ancam Neraca Dagang RI? Ini Kata Peneliti!

Peneliti dan Analis Kebijakan CIPS Hasran mengatakan, perang Iran-Israel berpotensi menggerus kinerja dan surplus ekspor Indonesia.

-

Pemerintah Kota Solo Beri Diskon Pajak 15 Persen untuk Hotel dan Restoran saat Solo Raya Great Sale 2025

Pemerintah Kota Solo memberikan diskon pajak sebesar 15 persen untuk hotel dan restoran saat penyelenggaraan Solo Raya Great Sale 2025